The development of the textile industry in the world over the last 40 years is a typical example of a product that has undergone major changes, in terms of organisation, production structure, technology and sales methods. From a typical labour-intensive industry which practically exhausted its development potential, by introducing large investments while reducing the workforce in countries that had been former leaders of world textile production, it has been transferred into one which has taken on the characteristics of capital-intensive activities. While the process of structural adjustment was underway in the developed countries regarding this industrial branch, followed by production reduction and labour force downsizing, specialisation and constant technological innovation, the promotion of new products and full product lines, at the same time the process of transferring production to other countries and the establishment of new centres of the global textile industry, whose main advantage, in addition to low labour costs, were significant sources of cheap raw materials, was in progress. This led to greater involvement of the textile industry in global international trade flows, marked by the continuous strengthening of the export position of a particular group of developing countries, which resulted in major structural changes in the regional distribution of textile production.

The last decades in terms of the development of the textile industry at the global level have been marked by processes of intensive structural adjustment which has resulted in the transfer of production to developing countries. This initiated the greater involvement of this industrial branch in international trade flows, with the constant strengthening of the exporting position of the new leaders in production, which, again, led to major changes in the regional distribution of exports and imports of textile products.

Textile industries from developing countries, especially from the Asian region, entered the world textile market, which, due to significantly lower labour costs and domestic production of natural textile raw materials, rapidly threatened the monopoly of developed countries in the international trade of textiles.

Protectionist measures introduced by developed countries in order to protect their markets and manufacturers, to some extent, reduced the competitive pressure exerted by developing countries and slowed down their conquest of the global textile market.

Additionally, the constant pressure of the developing countries initiated the restructuring of the textile industry in the developed countries, which was necessary for survival on both the domestic and international markets. The aim of the restructuring has changed over time, ranging from the technological modernisation of mass production and the implementation of the results of scientific research concerning new technologies and the production of synthetic fibres in the spinning, weaving and finishing of textiles to the shifting of the production of standard, mass products to developing countries in the form of subcontracting, the closing of unprofitable production facilities and the specialisation of production.

In the manufacturing of the classic apparel range, particularly men’s suits, men’s coats, women’s dresses and women’s suits have been recorded, while the production of separates, especially jeans and jackets, has shown an increase. The current competitive struggle in the textile product market at the global level has brought about a number of innovations in production technology, its organisation and sales logistics. The combined effects of such technological advances have enabled the spatial and functional fragmentation of textile production and its vertical disintegration in terms of performing labour intensive parts of the production in countries with lower labour costs. The functional re-integration of the production process was made possible due to liberalised international trade channels, which led to the creation of supranational and global production and supply chains. A group of leading transnational corporations play a major role in organising and coordinating these global production systems

Today, the world’s consumers spent around 1.2£ trillion worldwide buying clothes. Around one-third of sales were in Western Europe, one third in North America and one quarter in Asia. Today, clothing and textiles represent about seven per cent of world exports. Globally, the workforce in clothing and textiles production was around 29 million. More than a quarter of the world’s production of clothing and textiles is in China, which has a fast-growing internal market and the largest share of world trade. Western countries are still important exporters of clothing and textiles, particularly Germany and Italy in clothing and the USA in textiles. The output from the sector is growing in volume, but prices are dropping, as is employment, as new technology and vertically integrated structures support improved productivity products – mainly clothing and carpets.

The reason for reducing the relative share of the textile industry in the newly added value of the manufacturing industry in the world can be traced back to the relatively lower production growth rates over the last 40 years, compared to the rapid growth of other propulsive branches. Due to the uneven pace and direction of structural changes in national economies, differences in the relative share of the textile industry in the newly added value of the manufacturing industry are evident in developed and developing countries. While the production of textiles in the manufacturing industry structure in the UK, USA, Japan, Spain and other developed countries has a relative share of 1.3 to 2% and the manufacturing of garments from 0.7 to 2.3%, in China, India, Turkey and other developing countries, which have a dynamic and strong textile industry, the share of the production of textiles is between 7 – 11%, while the production of garments account for 4 to 8%.

Clothing and textile industry and employment The fashion and textile industry can be divided into five subcategories by functions such as Manufacture and production of clothing and textiles (manufacture and finishing of textiles and clothing, manufacture of interior textiles and carpets, manufacture of industrial and technical textiles.

Wholesale of textiles and fashion (wholesale of fabrics, threads, textiles, clothes and footwear). Other manufacture related to textile and fashion industry (manufacture of shoes and leather, synthetic fibre, fibreglass and mattresses). Retail of textiles and fashion (retail of fabrics, carpets threads, curtains, clothes, accessories, handcraft goods footwear, mail-order and online stores). Maintenance of clothing and textiles (shoes make and laundries)

20 percentage of the UK’s annual consumption (by weight) of clothing and textile products is manufactured in the UK. Consumers in the UK spend about £800 per head per year, purchasing around 3 million tonnes (which means 45kg per person) of which one eighth is sent for re-use through charities and the rest is discarded.

The competition will increase in the sector, as skill levels and investment in developing countries continues to grow. Prices will continue to be driven down in the UK. Innovations may include new production technologies to reduce the labour requirement of garment completion and development of novel smart functions. Some Requirement from consumers and pressure legislation is likely to drive increasing demands for environmentally sensitive products in the close future. In the short term, this is likely to focus on the use of chemicals but may extend to include re-use of materials and substitution of alternative materials

What is the future in UK textile?

So, for products in which raw material production dominates, in addition to measures to extend product life, alternative processes or materials should be focused on to be pursued. If we would like to eliminate most toxic releases. We should switch from conventional to organic cotton growing, at the cost of price rises in the UK.

The key energy requirements for cotton garments are dominated by washing, drying and ironing. In response, wash temperatures are able to be reduced and tumble drying avoided. The new process may provide resistance to odours. This provides reducing the total number of washes or allow faster drying with less ironing.

The UK’s current behaviour in disposing of used clothing and textiles to landfill, will not be sustainable as volumes are significantly growing. Incineration may preferable to landfill, as it allows energy recovery and also reduces final waste volumes.

The second-hand sector is growing and there is further demand, so improved collection and sorting procedures will be provided in reducing waste and providing useable clothes to developing countries. Recycling will be more significant for materials with high impacts in the production phase.

Over 26 million people work to produce clothing and textile around 70% of clothing workers are women. The textile sector has been increasingly dominated by Asian countries within the next ten years, employment in the sector has increasingly been concentrated in Pakistan, India, China, Romania, Bangladesh, Cambodia and Turkey

The main trend in UK clothing demand is the growth in fashionable, low priced, ‘disposable’ clothing Some High Street Companies are examples of companies providing relatively low priced fashionable clothing through flexible, fast supply chains which allow clothing collections to be changed every three to four weeks.

This encourages consumers to shop more often and the number of items bought annually is growing. In response to this trend, supermarkets, clothing chains, have developed high fashion brands at very low prices. In some cases, these outlets are able to make very quickly copies of famous designers’ fashion model.

In the 1990’s many high street retailers significantly increased their purchases from new and emerging markets including, China, Pakistan, Bangladesh and Turkey. UK retailers and brands can currently access goods from Turkey duty-free.

Under the Generalised System of Preferences, UK retailers and brands have been able to similarly access clothing and other goods from Bangladesh, Cambodia, Myanmar and Pakistan duty-free.

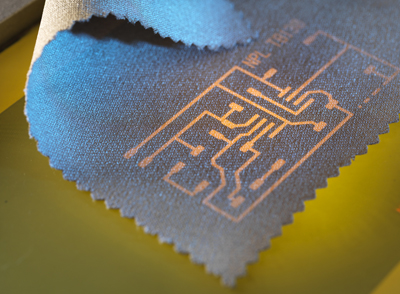

We strongly would like to emphasise that. There are major growth opportunities for the UK market in medical textiles, advanced materials and composites and smart textiles.